How it works?

Retirement Planning Overview

We know there are so many pieces to the puzzle. It's overwhelming.

That's why we have developed a simple, easy to follow process to guide you through. First, our retirement calculator helps you understand what data you need and where to get it. Then it runs your case through our sophisticated calculation engine to identify all possible paths to a secure retirement. And when you choose a path, we help you manage the ups and downs of life with the same time-tested approach used by pension plans and insurance companies to manage uncertainty.

Retirement planning is about finding your perfect balance between: what percent of pay you save each year, when you can retire, and what quality of life you can enjoy in retirement.

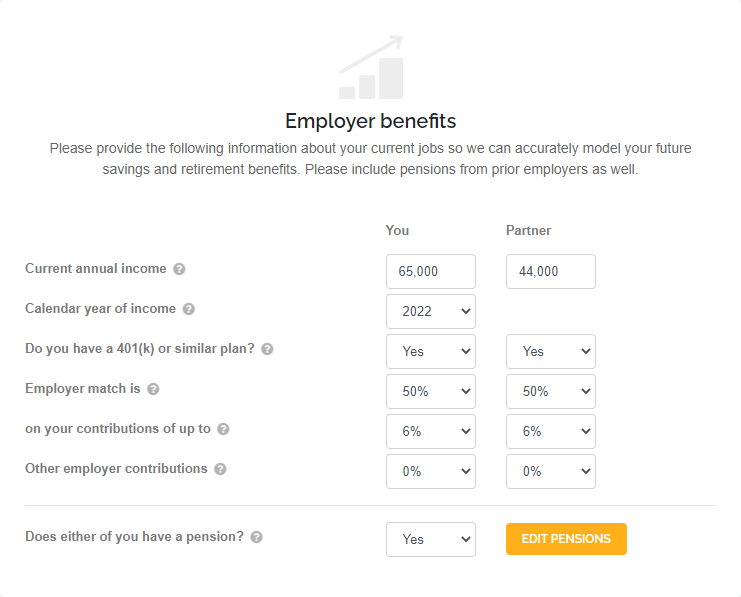

MoneyBee calculates all possible combinations of these three basic components. We do that by carefully projecting all your benefits and required expenses. Inputs are based on current information - intuitive and well explained.

Our calculations are intentionally simplified and are based on assumptions about many uncertain future events. In doing so, we err on the side of conservatism. We encourage you to do the same when building your MoneyBee model.

As your circumstances change, you can continue to re-calibrate your MoneyBee model and make timely and gradual adjustments to your savings rate, planned retirement age or desired lifestyle in retirement. It's a long and winding road, and we're in this together.

We take the security of your data very seriously. All your data is subject to a strong 256-bit encryption in transit. We use Amazon Cloud (AWS) to host our databases, which are also strongly encrypted at rest. Our servers are protected by a firewall monitored 24/7 by a top data security firm.

Financial advisers are always welcome at MoneyBee. We value your expertise and appreciate your knowledge and experience, and our community does, too. We offer additional (paid) services to financial advisers to enhance your client work.

Case study

This case study illustrates what information you will need to enter and what your results will look like.

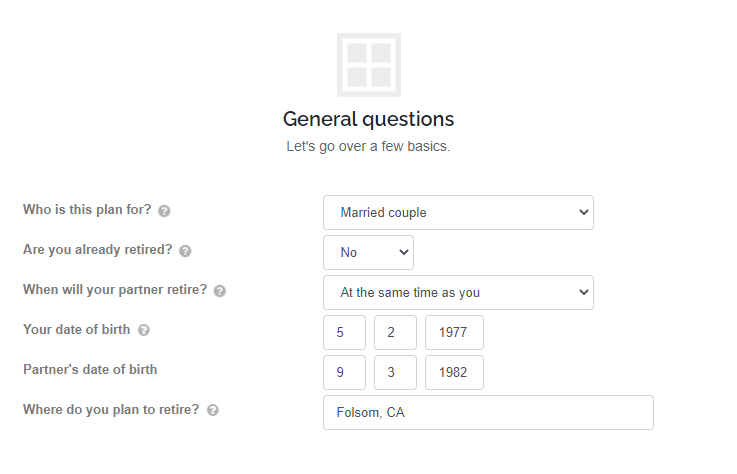

General questions

John and Jill are a married couple living in California with their two kids. They are currently in their 40s and are both working. They hope they can retire in California, if they can afford it.

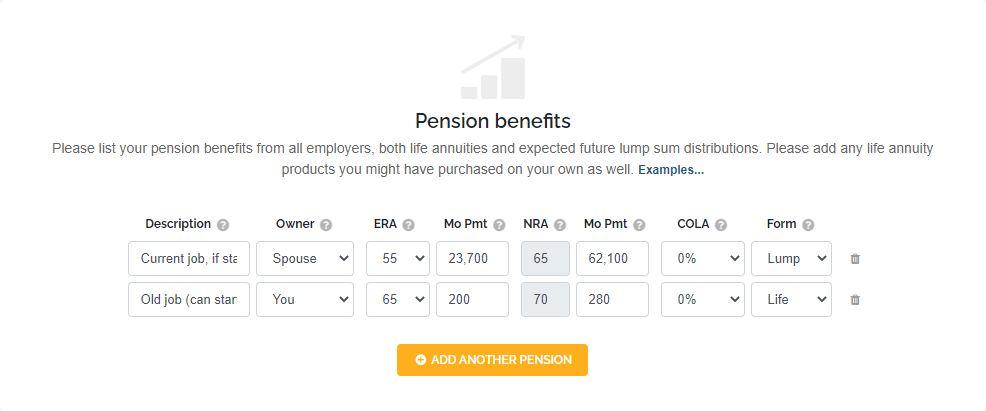

Pension benefits

John has a pension with a prior employer. Based on his benefit statement, his pension will be $200 a month if he starts at age 65 and $280 if he starts at age 70.

Jill has a cash balance plan with her current employer, which allows her to take her entire benefit as a lump sum. She also gets benefit statements, but they reflect only service to date, while she plans to work there until retirement.

She went to her employer's online pension estimator and got her projected pension if she works until 55 and 65, respectively. She entered these numbers here.

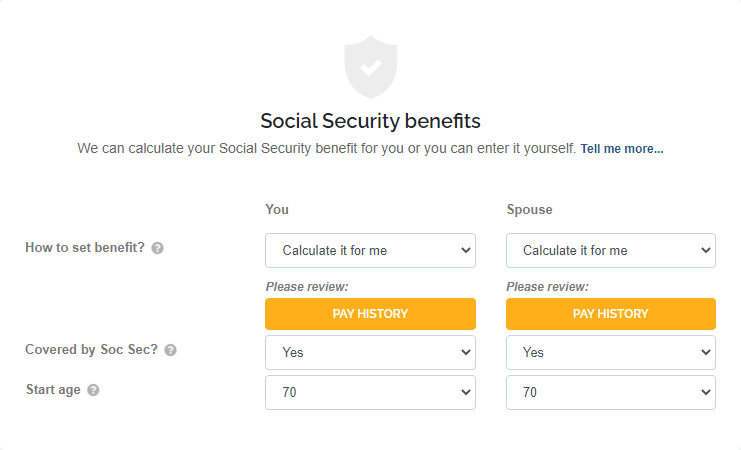

Social Security benefits

John and Jill let MoneyBee estimate their Social Security earnings history from their current pay.

When they get their next Social Security statements, they plan to enter their complete earnings history to get a more accurate calculation.

They want to start their Social Security payments at age 70, because they can afford to wait that long.

Not all of us can.

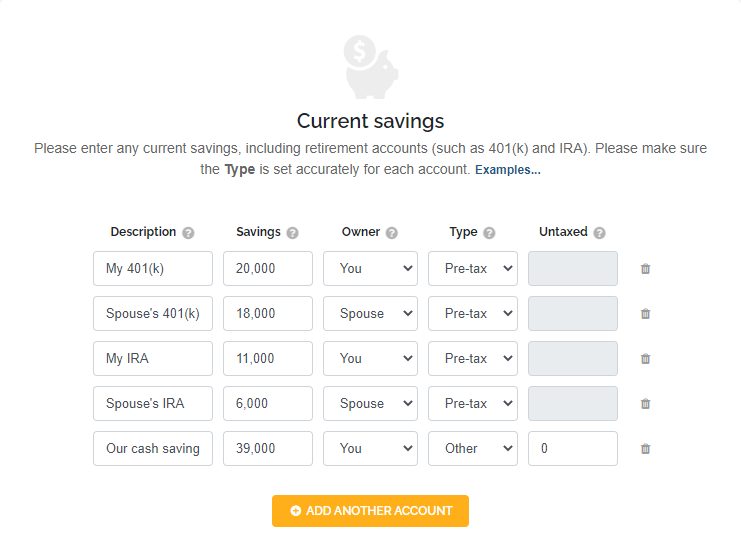

Current savings

John and Jill have also been able to set aside some retirement savings on their own.

They included their "cash savings", from which they plan to pay for their kids' college.

Note: If you plan to draw prior to retirement on any savings included here, you also need to tell us in the "Events" section when and how much you will draw. Otherwise, MoneyBee will think that all this money will be available to you when you retire!

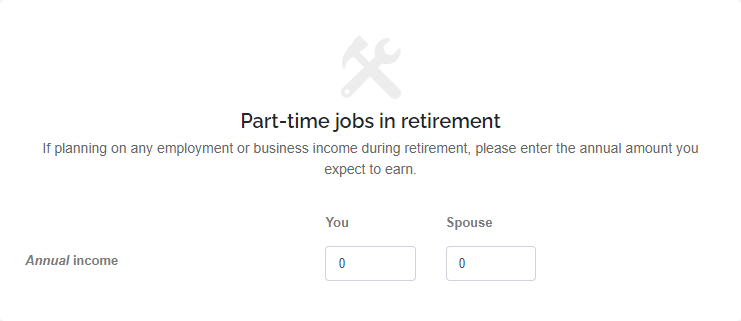

Part-time jobs in retirement

It was tempting to think they can continue working part-time or have a side business after they retire. However, they decided to be conservative and not count on any such income.

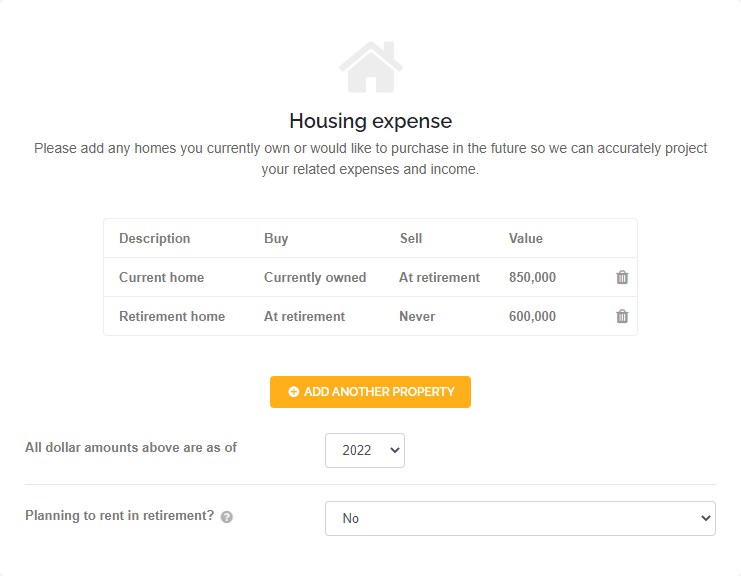

Home expenses

John and Jill own their home and have a few years left on their mortgage.

They plan to sell their home at retirement and downsize to a smaller one, with just 20% down. They plan to add their net gain to their retirement savings.

They won't be paying rent in retirement. They'll live full-time in their retirement home.

Here is how they set this up.

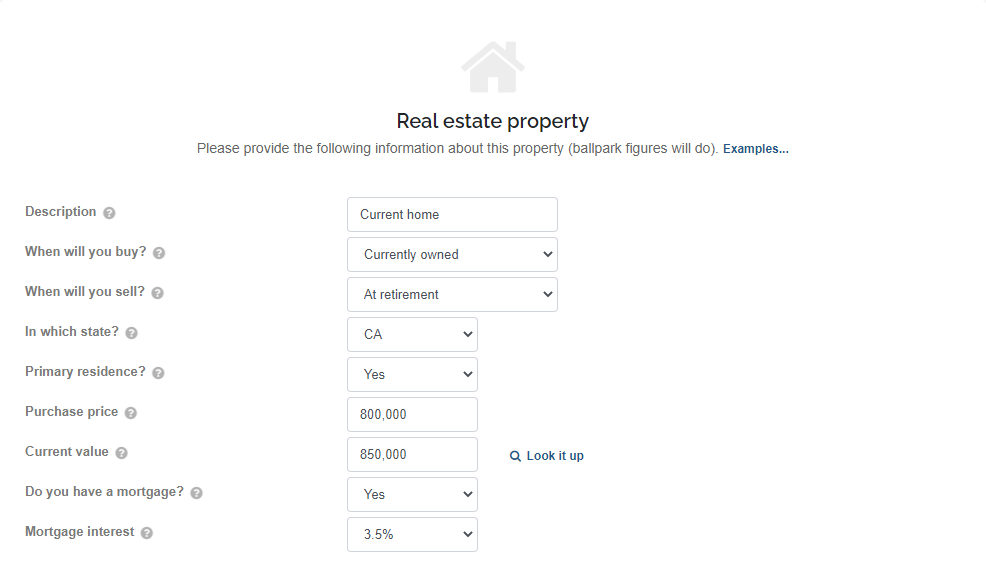

Current home inputs

Here's the information they entered for their current property.

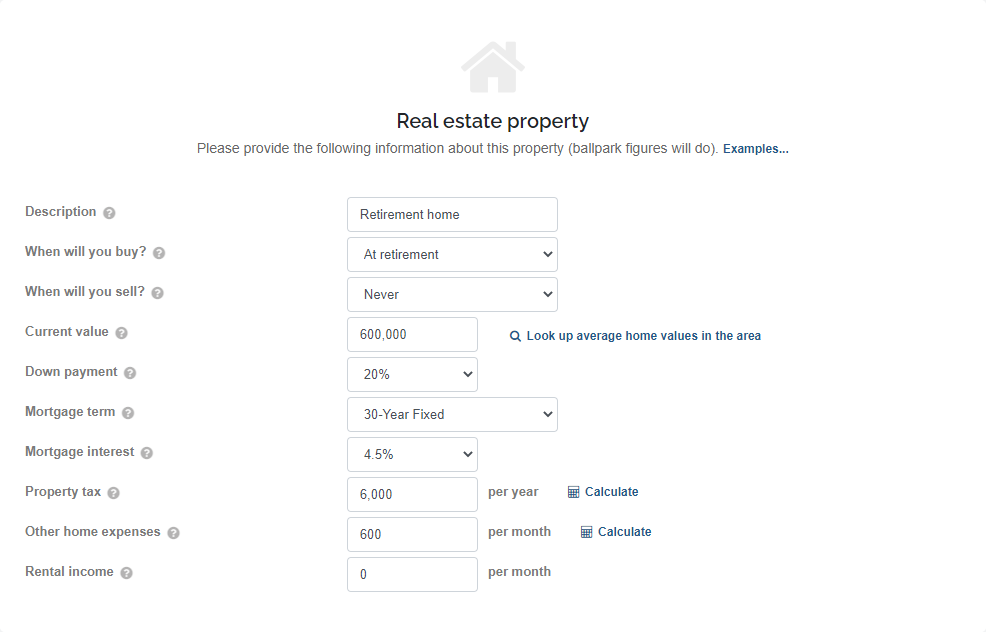

Retirement home inputs

And here's the information they entered for their future home.

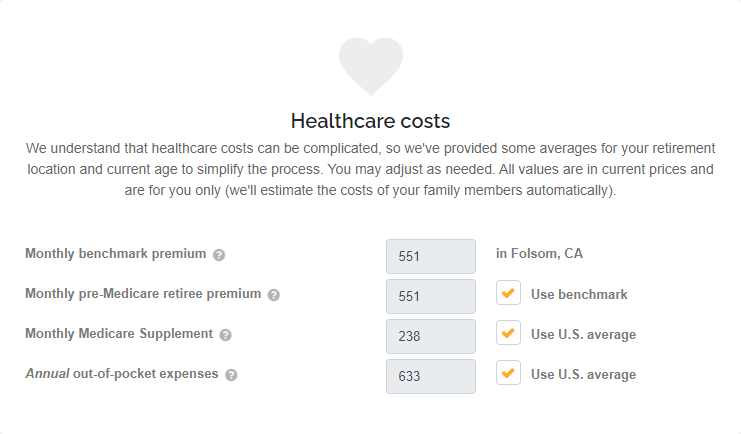

Health care costs

The Health section is fully automated, if you want it to be!

We look up your benchmark health premium in the city where you plan to retire (and we update it automatically each year).

We also let you set your other medical expenses to the national averages from the Bureau of Labor Statistics.

John and Jill left these defaults unchanged.

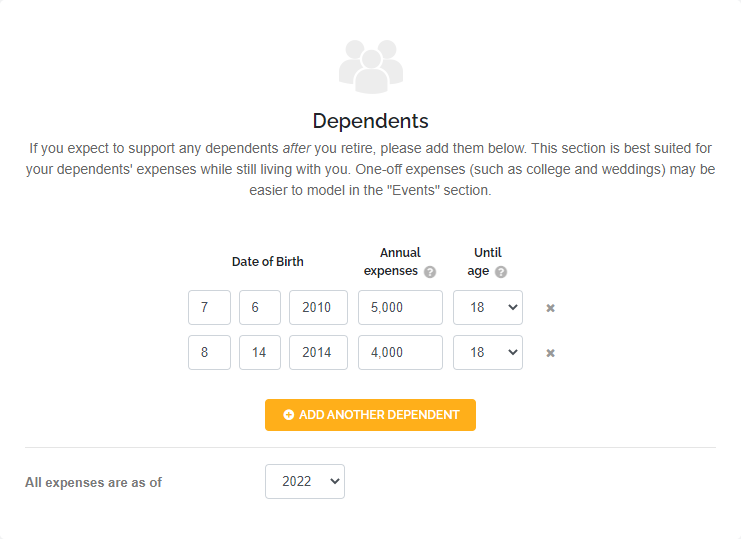

Dependents

Most users skip this section because they don't expect to be supporting kids after retirement.

John and Jill set it up to be on the safe side.

On this slide, they entered the cost of having their kids live with them until they go to college.

They handled saving and paying for their kids' college in the "Events" section (coming up).

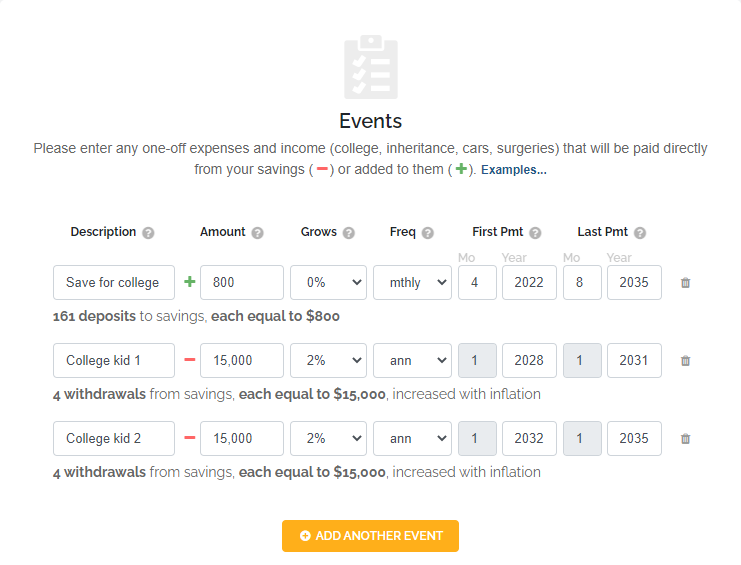

Events

Jim and Jill plan to save a constant $1,000 a month towards their kids' college, from now until August 2030 (when their last child starts his last year in college). This is on top of their retirement savings.

They want to pay $15,000 per year per child during each child's college years, in current prices. They expect this amount to increase with 2% inflation to the actual payment year.

They also assume that they will pay the entire $15,000 (increased with inflation) at the beginning of each school year. Their first child is expected to start her freshman year in 2022 and her senior year in 2025. Their second child is expected to start his freshman year in 2027 and his senior year in 2030.

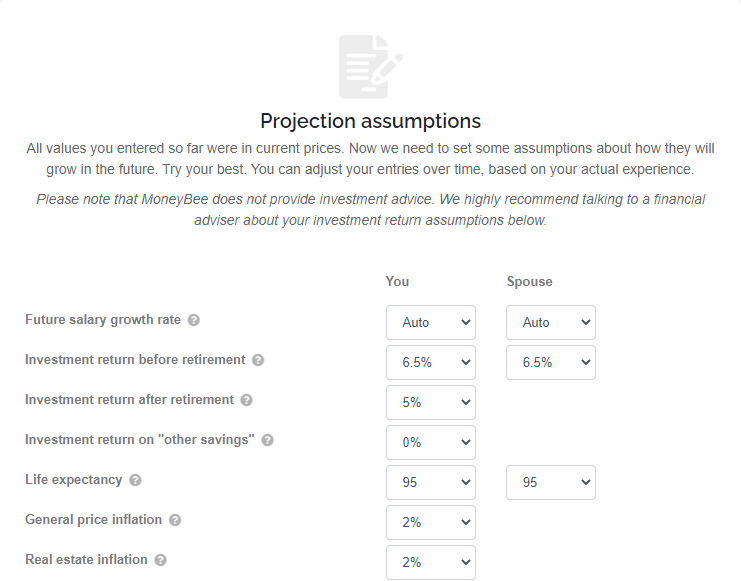

Projection assumptions

MoneyBee offers a default value for each assumption.

While these defaults are reasonable in general, they may or may not be appropriate for your own situation.

John and Jill did a little bit of research, especially about their assumed investment return.

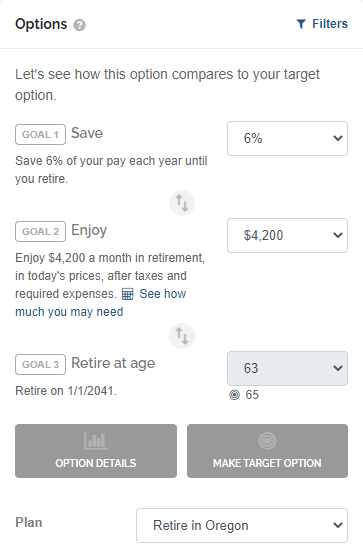

Options

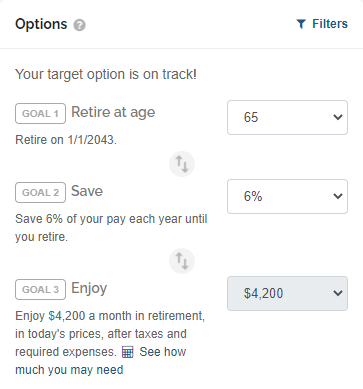

Once they answered all the questions, MoneyBee calculated all possible combinations of:

1) what percent of pay they save each year,

2) at what age they can retire and

3) how much personal money they can enjoy in retirement.

To make it easier to browse your options, MoneyBee allows you to prioritize these three components.

John and Jill opted for saving 6% of pay, retiring when John is 65 and enjoying a monthly personal budget in retirement of $3,900 (in today's prices).

They made this their "target option".

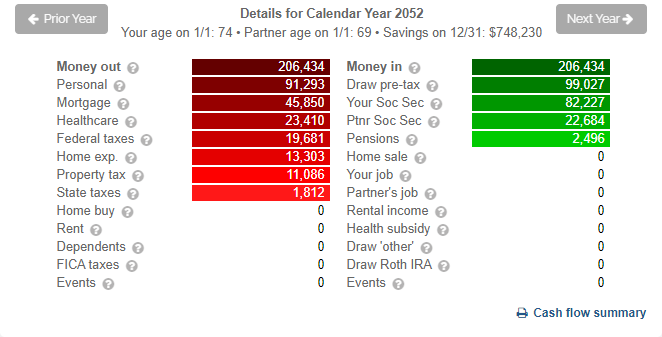

Option details

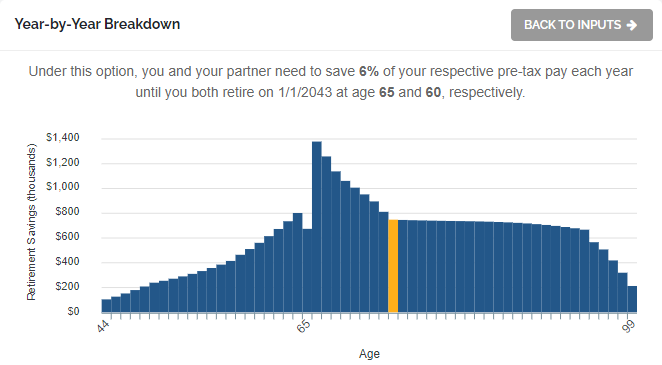

To help you better understand each option, MoneyBee provides a detailed breakdown of what exactly you need to do this year and how the math will play out year-by-year for the rest of your life, if assumptions hold.

A hypothetical example of what your "personal budget" can afford is also provided.

Plans

MoneyBee also allows you set up multiple "plans".

In addition to the plan they just created, which they called "Retire in California", they created a backup plan - "Retire in Oregon".

All they had to do is click the "Make a Copy" button.

This creates an identical copy of all your inputs so you don't have to start from scratch.

Compare plans

Then in the new plan, they changed the current value of their retirement home from $600,000 to $125,000 in the "Home" section and changed their retirement state to Oregon in the "General" section.

As one can imagine, their results changed dramatically!

Based on their results, they decided they will save 6% of pay and plan to retire in California on 1/1/2043 when John is 65.

If they decide working to 65 is too long, they can retire in Oregon two years earlier when John is 63.