The Best Age to Start Social Security Benefits

In this post, we use MoneyBee to look for the best age to start Social Security benefits. Is it 70? It all depends.

You can start receiving your Social Security retirement benefit as early as age 62 and as late as age 70. Your benefit amount will be based on your commencement age. Let's take a look at a few different scenarios using MoneyBee to illustrate the pros and cons of starting your benefits early or late.

Why use MoneyBee for these illustrations?

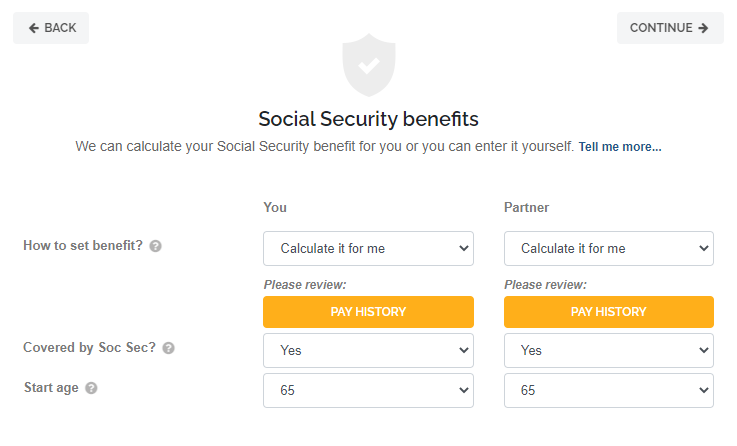

MoneyBee calculates your Social Security retirement benefit from scratch for each retirement age, exactly matching the Social Security Administration (SSA)'s calculators. It also does "future dollar" projections using the SSA intermediate assumptions used in their own projections. This way, all aspects of your retirement planning will be appropriately projected forward, not just your investments.

Why delay our Social Security benefits?

It's your money, you've earned it, so why delay claiming it? Under current rules, your benefit will be increased by 8% for each year you delay commencing it past your Social Security full retirement age (age 67 if born after 1/1/1960, otherwise you can check here). This increase is generally considered to be more generous than "actuarial equivalance". This is a fancy way of saying that, under some reasonable mortality and interest assumptions, you will be better off waiting until age 70.

However, whether you will be better off will depend on your life expectancy and investment return assumptions. There are other considerations that come into play too, such as the age at which you retire, your desired legacy money, the level of your savings and your eligibility for a premium tax credit. That's why MoneyBee takes a more practical approach by producing a detailed projection of your full financial pictire in retirement and letting you try out a few different Social Security commencement ages to see what works best for you.

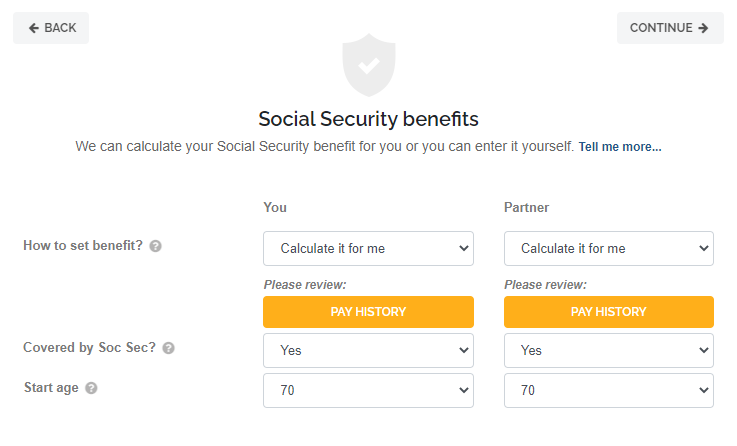

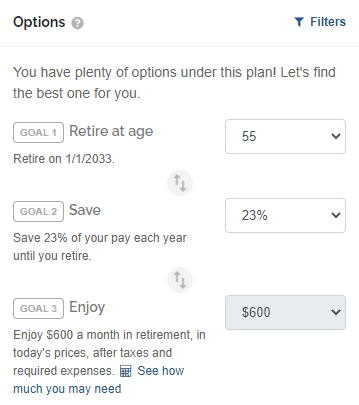

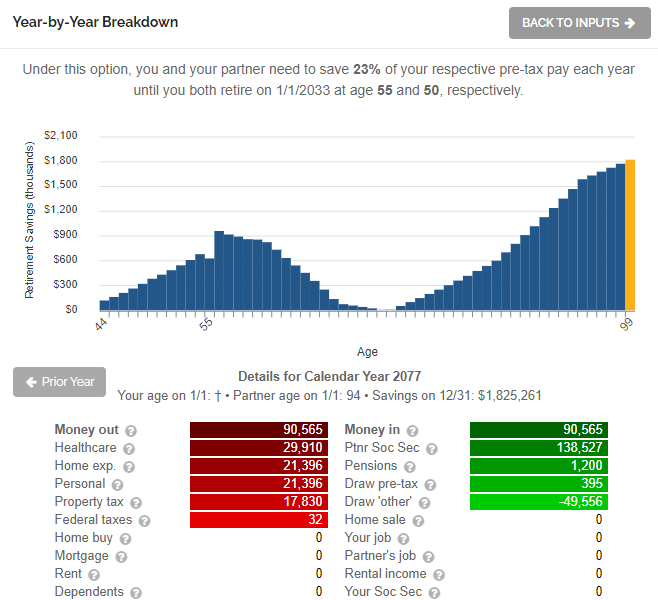

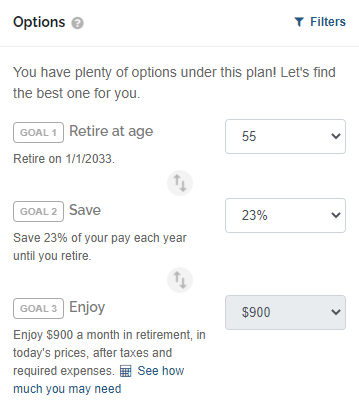

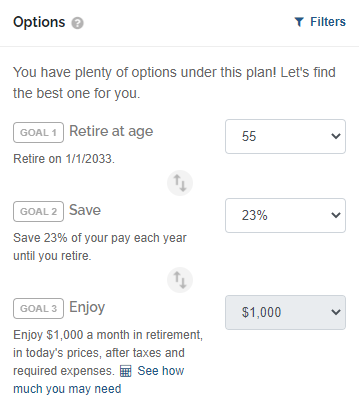

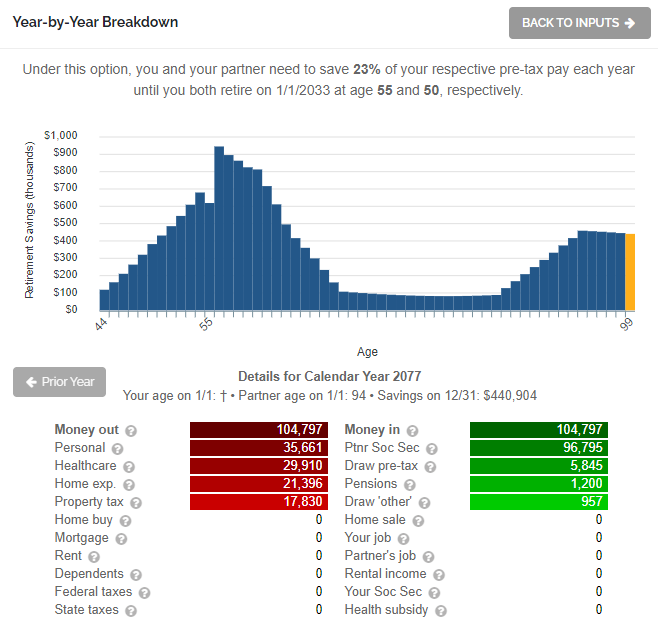

Early retirement with limited savings

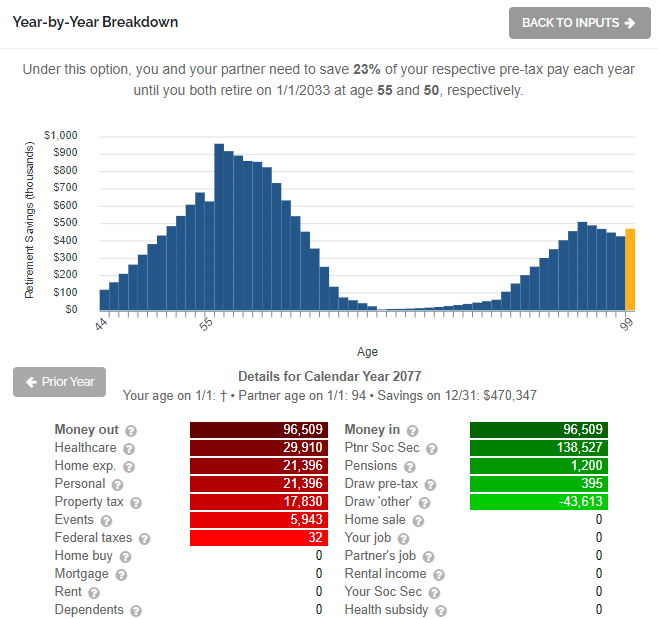

There are cases when we simply don't have a choice but to start our Social Security benefits as early as possible. If you plan to retire early with limited savings, you may quickly run out of money unless you claim your Social Security at age 62. If the couple in the following example wants to retire at 55 and claims their Social Security retirement benefits at 70, they will need to save 23% of pay each year and will be able to afford a personal budget in retirement of only $600 a month (after taxes and required expenses, such as housing and health care, indexed with inflation):

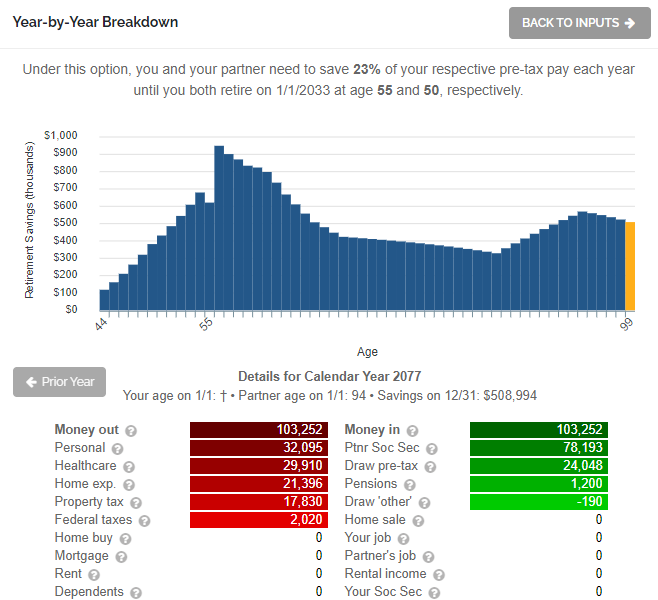

The following chart shows how their savings will collapse to nearly zero by the time the older spouse reaches age 70 and starts claiming Social Security:

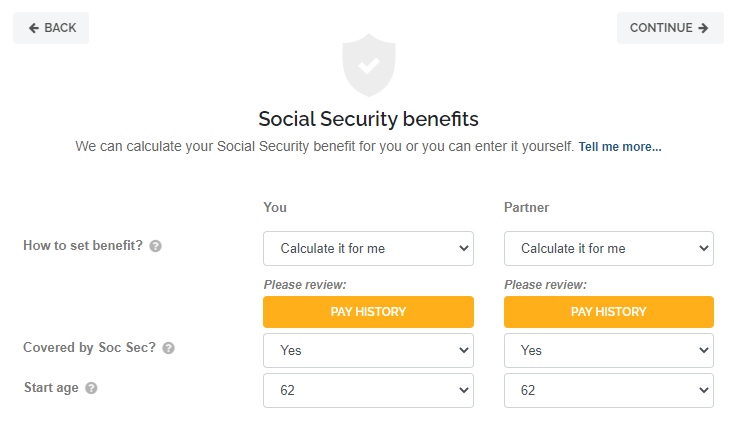

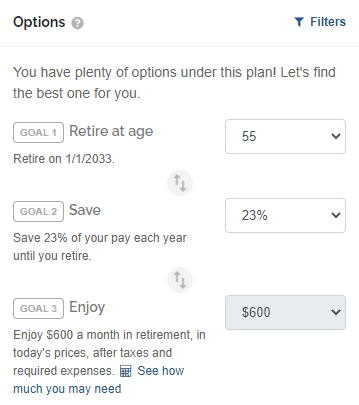

All else the same, their personal budget will improve from $600 a month to $900 a month if they both claim their benefits at age 62:

Notice, however, that there is another important number that changed in the opposite direction - their legacy money. If they claim their benefits at 62 they will be able to leave about $509,000 to their heirs at the time of last death:

That number was $1.8 million under the age 70 scenario! Don't bother taking out your calculator. An extra $300 a month for 45 years does NOT add up to the $1.3 million difference. Not even close. So this couple needs to choose between a higher personal budget in their earlier years or a greater overall value, which won't be available until their later years.

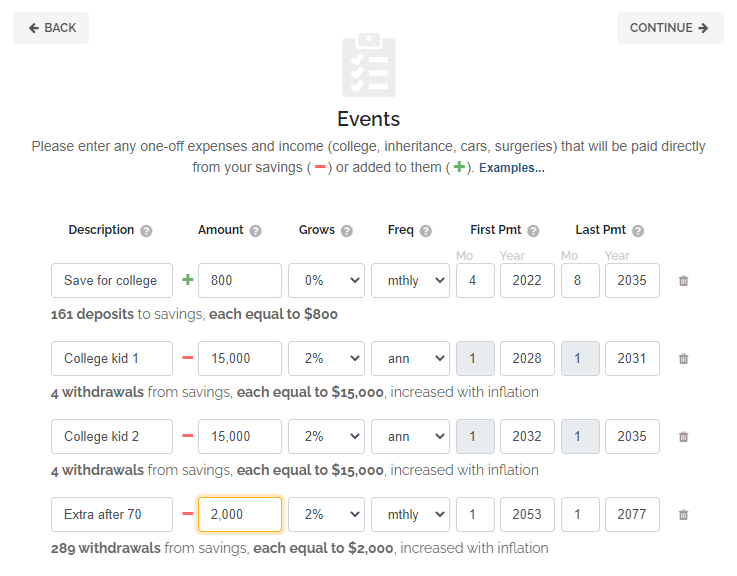

If they claim at 70, they don't have to stick to a personal budget of $600 per month after age 70. The following chart shows what happens if we add an event of $2,000 per month (indexed at 2% per year) that starts after they both turn 70:

Their lifelong personal budget remains at $600 a month, except that now they have another $2,000 a month coming after age 70:

Their legacy money will end up at just around the half million mark they got if claiming at 62:

So the choice is really between a personal budget of $900 per month for 45 years (if claiming at 62) versus $600 per month for the first 21 years and $2,600 per month for the remaining 24 years (if claiming at 70), with all figures increased with inflation.

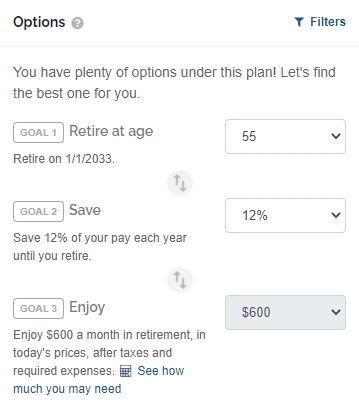

Note also that, by claiming at 62, they can achieve a $600 personal budget saving just 12% a year (instead of 23% if they claim at 70):

So claiming at 62 may also make it achievable for them to retire at 55 in the first place, if they can save 12% per year but cannot realistically do 23%.

Before we leave this example, let's see what happens if they claim at age 65. This couple has very large after-tax savings. They can draw on these savings before age 65 in order to minimize their taxable income and maximize their premium tax credit. Keep in mind that health care can be extremely expensive before Medicare kicks in at age 65, so the premium tax credit can make an enormous difference. By claiming their Social Security before age 65, they increased their taxable income and lost some of their premium tax credit. Claiming at 65 fixes this problem and gives them a better personal budget:

However, their legacy money will go further down to $441,000 (compared to the $509,000 if they claim at 62). Overall, claiming at 65 is not that different from claiming at 62, both providing a much lower lifelong value than claiming at 70.

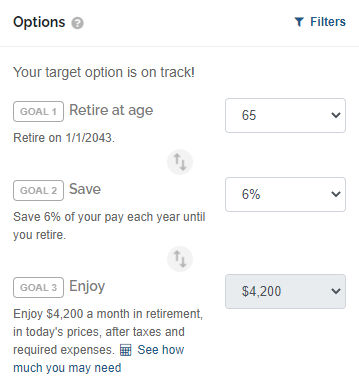

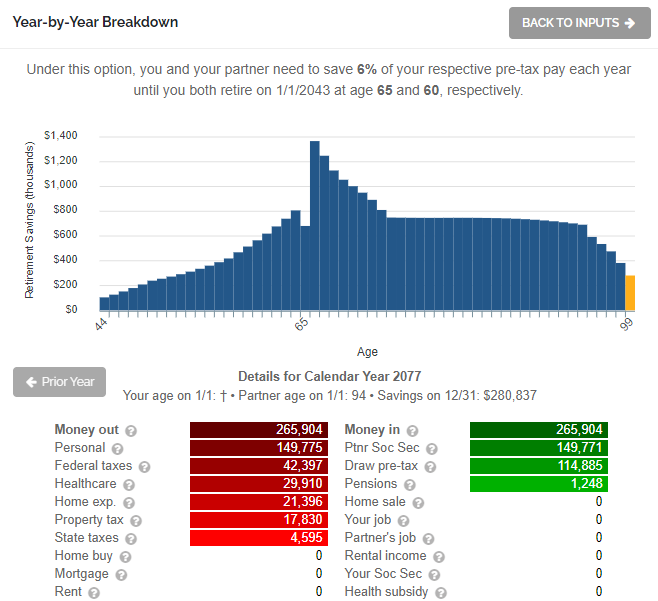

Retirement at 65 with decent savings

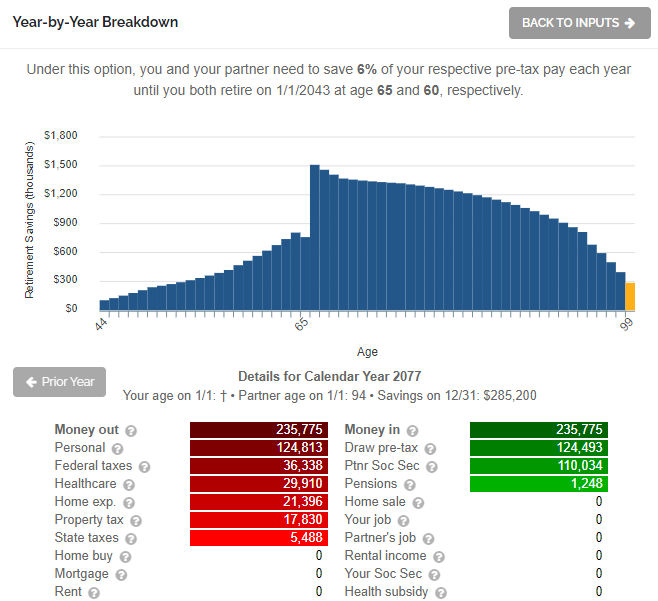

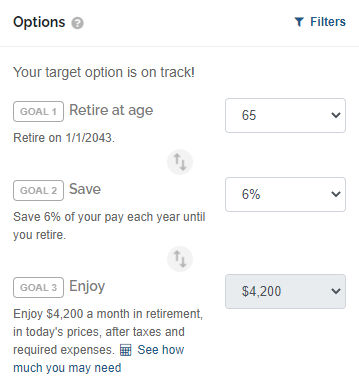

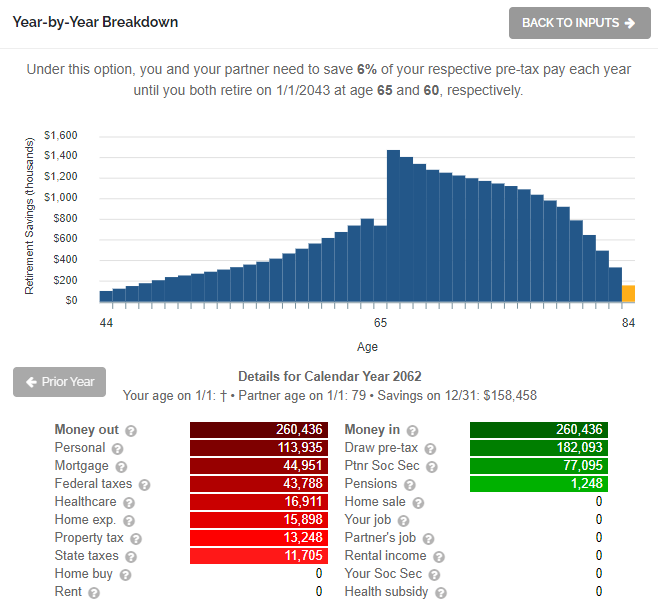

If we retire at a more typical age, such as 65, we will have fewer options as to when to start our Social Security benefits. We are also more likely to have the savings we need in order to delay our Social Security check. Here are the results the couple in our example got if they retire at 65 and 60, respectively, and both claim their Social Security at 70:

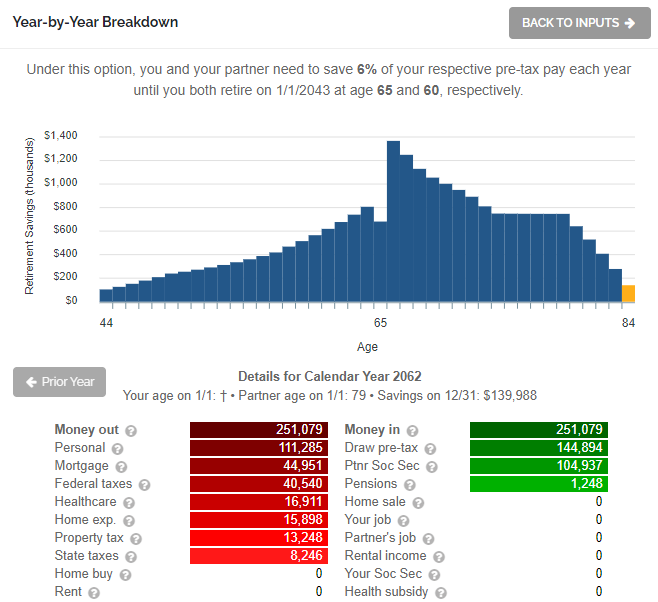

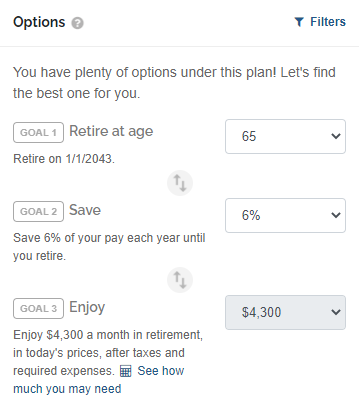

If they claim at 65, their personal budget gets significantly worse, while their legacy money remains unchanged, so there is nothing to gain from claiming their benefits earlier:

Short life expectancy

In all examples so far, we assumed life expectancy of 95 for both spouses. Is waiting until age 70 to claim benefits still a good idea with a shorter life expectancy? Let's change their life expectancy to 80 and re-run. If they retire at 65 and 60, respectively, and both claim their Social Security at 70, their personal budget remains the same as under a life expectancy of 95, just their legacy money drops significantly:

If they claim at 65, their personal budget actually improves slightly, while their legacy money remains about the same:

Does this suggest that with life expectancy of 80, they should claim at 65 so they can enjoy an extra $100 a month? In this case, the difference is so small, it probably doesn't matter. In general, however, it is probably not the best idea to overspend based on a short life expectancy assumption. If we outlive our assumptions, we will need to back paddle to make up for our earlier overspending. It seems safer to assume a long life expectancy and if we die earlier, simply leave a little more to our loved ones than planned.

Conclusion

For the couple in our example, claiming their Social Security retirement benefits at age 70 provided the best overall value. There may be situations where claiming their Social Security early can allow them to achieve certain early retirement options, at the expense of lower value over their lifespans. While everyone's situation is different, now you know what scenarios you can run in MoneyBee to determine what makes the most sense for you.