Pre-Medicare Health Insurance for Early Retirees

What is the long-term impact on early retirees of buying health insurance in the U.S. before age 65?

Buying health insurance on our own can be extremely expensive, especially in our late 50s and early 60s. For that very reason, many Americans delay retirement until Medicare kicks in at age 65. Those who do retire early sometimes move to countries with free or inexpensive health care until they reach 65. In this article, we use MoneyBee to run a few scenarios and see how buying health insurance at home affects our overall retirement planning.

Why MoneyBee is the perfect tool for this experiment?

MoneyBee automatically looks up the benchmark health premiums (second cheapest silver plan from an exchange) for your age and retirement area. It uses it as your default health premium and projects it with data-driven health care age and price inflation assumptions. We are not aware of any other retirement calculator (paid or free) that uses this kind of sophisticated health care cost projection.

Our sample person

For this experiment, we use the same example as in our case study. This is a California couple in their mid-40s with two kids, a mortgage and average income. In their case, retiring early will already be very ambitious because their current retirement savings are not very high, their kids will be college and their mortgage won't be paid off. What we are interested in is the incremental difference in their results if they retire at 55 and buy health insurance versus retire at 55 and don't buy health insurance.

Retire at 55 with health insurance and some subsidy

Again, retiring at 55 will be tough for this couple. They would need to save 30% of their pay and will be able to enjoy a personal budget of only $1,200 a month (in current prices):

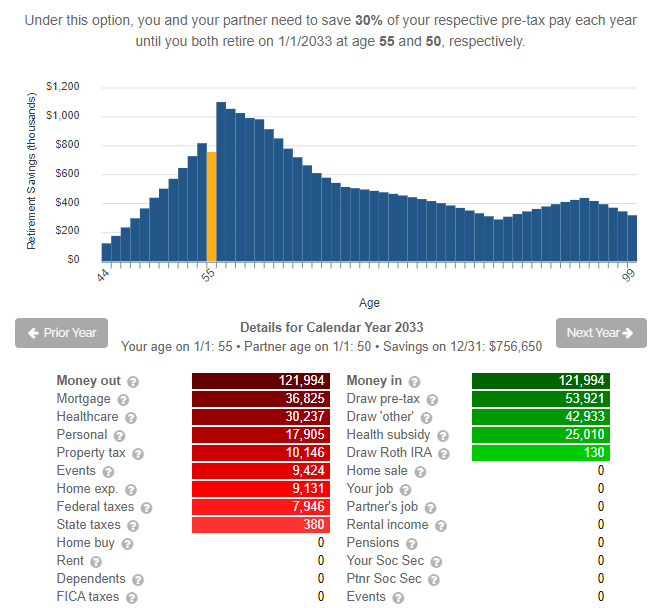

Now let's take a look at the year-by-year breakdown to better understand what is happening. At age 55, they will still have some after-tax saving (called "other savings" in MoneyBee). MoneyBee assumes that they will tap into those first to minimize their taxable income. In fact, they will be eligible for a premium tax credit (called "Health subsidy" in MoneyBee), which will pay most of their health premiums!

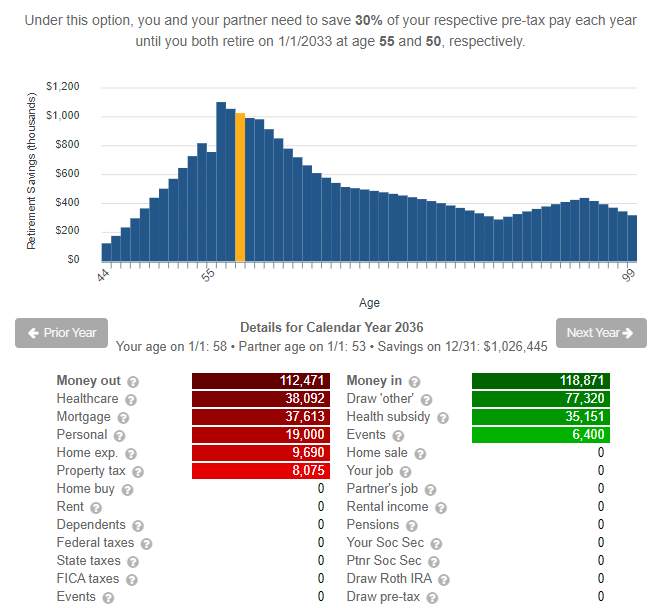

After they downsize their home at the end of their first year in retirement, their after-tax savings will increase even more. By age 58, their health care costs will exceed their mortgage, since it grows with both price and age inflation. Luckily, the health subsidy will continue to pay most of that cost:

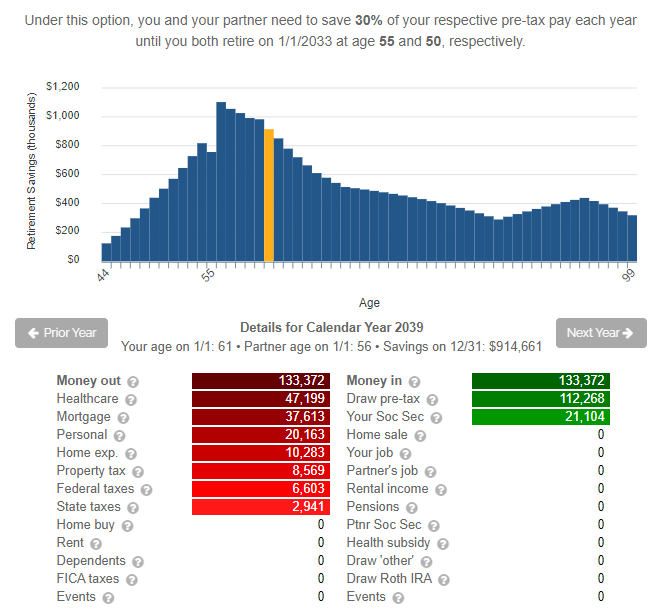

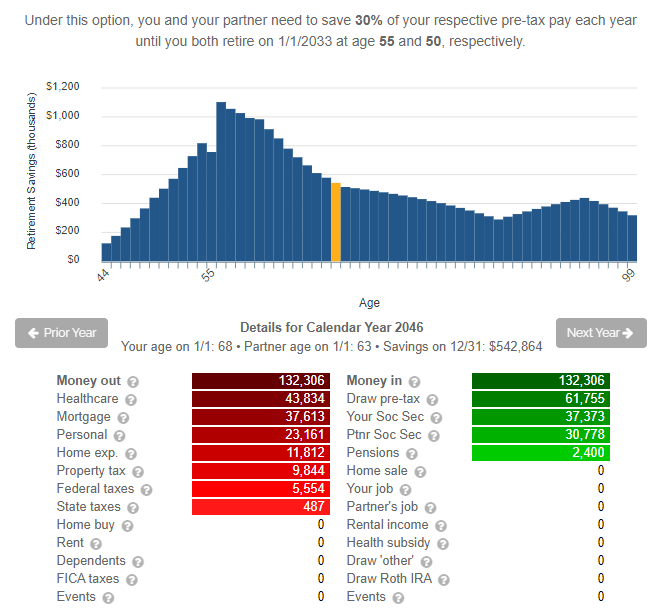

However, by age 61, their after-tax savings will be exhausted and they will have to tap into their pre-tax savings. The health subsidy disappears, while their health care costs continue to grow aggressively. Their savings start to decline quickly:

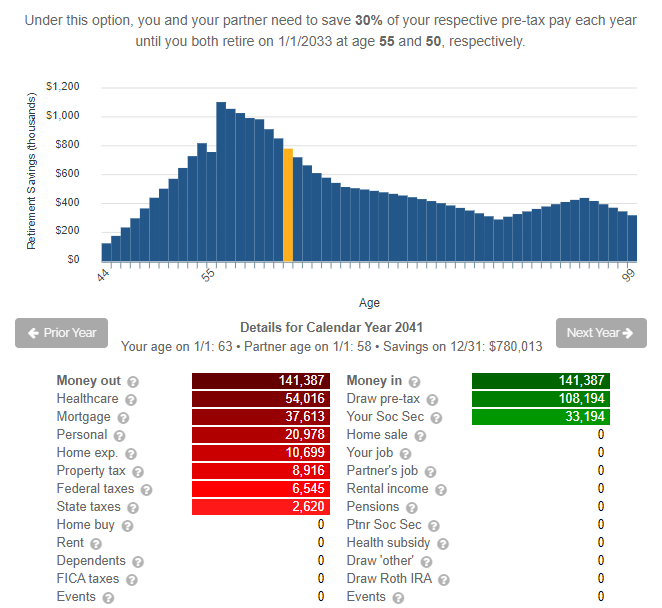

The worst comes a couple years later:

The pain continues even after one of them turns 65 and is covered by Medicare. Just one of them having to buy pre-Medicare health insurance is still quite steep:

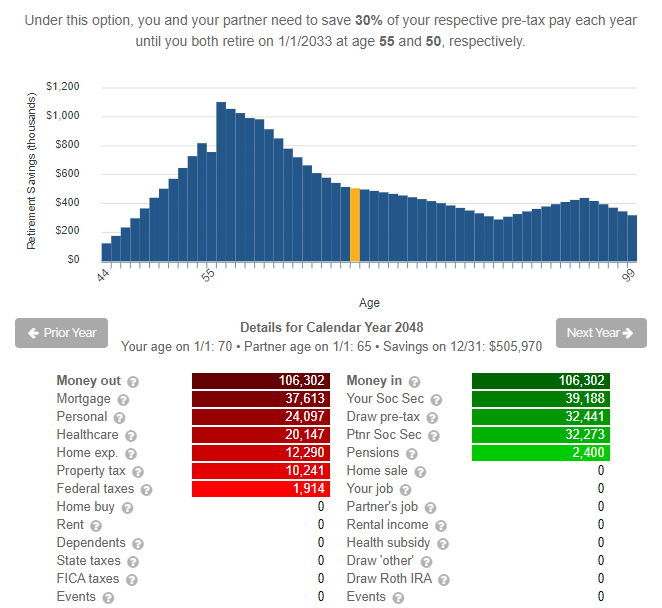

Now look at the difference a couple years later when both of them are covered by Medicare:

Retire at 55 without health insurance

For the same couple, we zeroed out the pre-Medicare premium to see how much difference that would make. In real life, if they didn't buy health insurance, they will probably incur higher out-of-pocket expenses. For our experiment, we didn't reflect these potential additional expenses. We wanted to see the absolute maximum of how much they can gain by not buying insurance (and nothing ever goes wrong).

Their results did change dramatically. All else the same, they can enjoy $500 more a month, in current prices, throughout retirement - not only before age 65:

Is this worth going without health insurance for 10 years (spouse for 15 years) at such sensitive ages as 55 to 65? Especially, given that some of this gain will be eroded by higher out-of-pocket expenses for doctor's visits, even if no major issues occur. To put things in perspective, they can nearly match this higher personal budget if they retire just a year later with health insurance:

Of course, this couple may be a little unusual because they have a fairly large amount of after-tax savings. This allowed them to keep their taxable income at a minimum and get the health subsidy for several years. But even if we turn off the subsidy, they can still match their no-insurance results by retiring two years later with health insurance:

Conclusion

The vast majority of MoneyBee users do not even consider retiring without health insurance. They treat it as a required expense and then look for the retirement option that works best for them. The above experiment shows that if they are eyeing early retirement, they can probably retire a year or two even earlier if they didn't buy pre-65 health insurance. But is it really worth retiring from a high stress job a year earlier only to end up stressing out about catastrophic health care expenses for 10-15 years to come?